What is AMM?

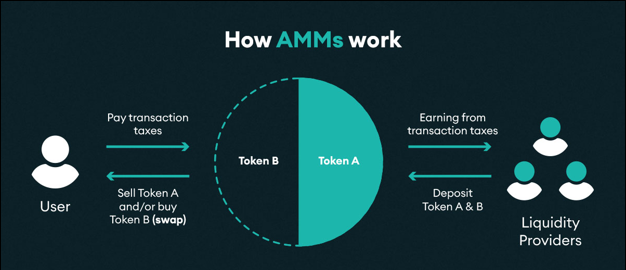

Automated market makers(AMM) incentivize users to become liquidity providers in exchange for a share of transaction fees and free tokens.

Automated market makers are autonomous trading mechanisms that eliminate the need for centralized exchanges and related market-making techniques.

A market maker facilitates the process required to provide liquidity for trading pairs on centralized exchanges. A centralized exchange oversees the operations of traders and provides an automated system that ensures trading orders are matched accordingly.

In other words, when Trader A decides to buy 1 coin at $Y amount, the exchange ensures that it finds a Trader B that is willing to sell 1 coin at Trader A’s preferred exchange rate. As such, the centralized exchange is more or less the middleman between Trader A and Trader B. Its job is to make the process as seamless as possible and match users’ buy and sell orders in record time.